Michael Joe Cini

27th February 2021

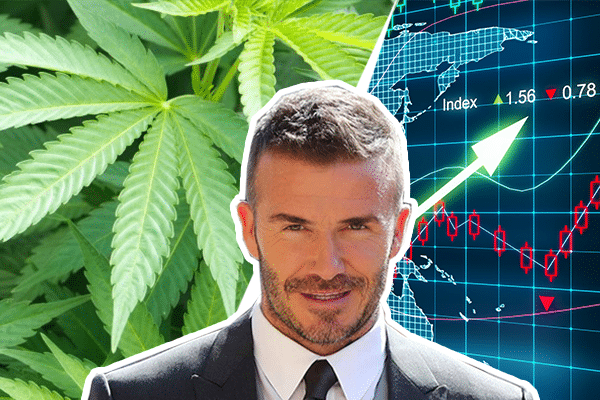

David Beckham-Backed Cannabis Company Takes the London Stock Exchange by Storm

David Beckham-backed cannabis skincare brand Cellular Goods share price rises more than four-fold on its launch day on the London Stock Exchange (LSE)

Beckham-backed cannabis skincare brand Cellular Goods saw its shares soar 310% from 5p per share to 20.5p today after its debut on the London Stock Exchange. This was the result of an early trading frenzy driven by institutional and retail investors.

Around 51% of the company, equating to 260 million shares, was up for grabs. Additionally, the company was oversubscribed by 13 times before it launched today on the LSE.

The Manchester United icon, one of the notorious investors in the cannabis venture, held a 5% stake in the cannabis venture through his investment vehicle DB Ventures.

As a result of the trading frenzy pushing the value of the venture, the value of Cellular Goods reached an impressive £25million. For Beckham, this meant that his holding rose by more than £2.5 million, reaching a pinnacle of £3.9m.

In a press release, Cellular Goods CEO Alexis Abraham shared his excitement stating:

“We are delighted with the tremendous support we have received from institutional capital and the unprecedented level of interest shown by retail investors for an IPO of this size.”

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said:

“With shares 13 times over-subscribed, initial demand for cannabinoid company Cellular Goods was always likely to be high and as trading has got underway it’s become a hot stock.

She added:

“David Beckham’s backing certainly added a celebrity glow to its listed debut. It might seem a bit of a curve ball for a man known for free kicks rather than scoring on the financial markets, but he certainly has form as a skincare and grooming guru.

The news continues the trend of medicinal cannabis companies entering the stock market.

Source: Sky News